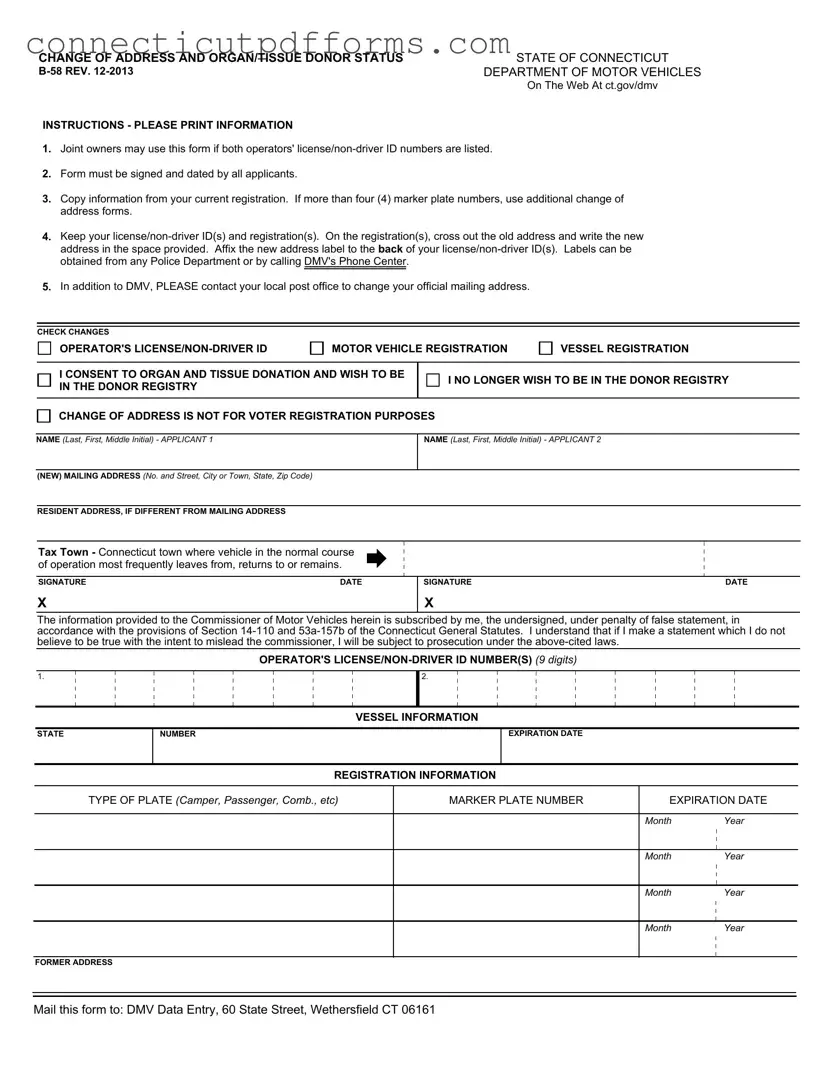

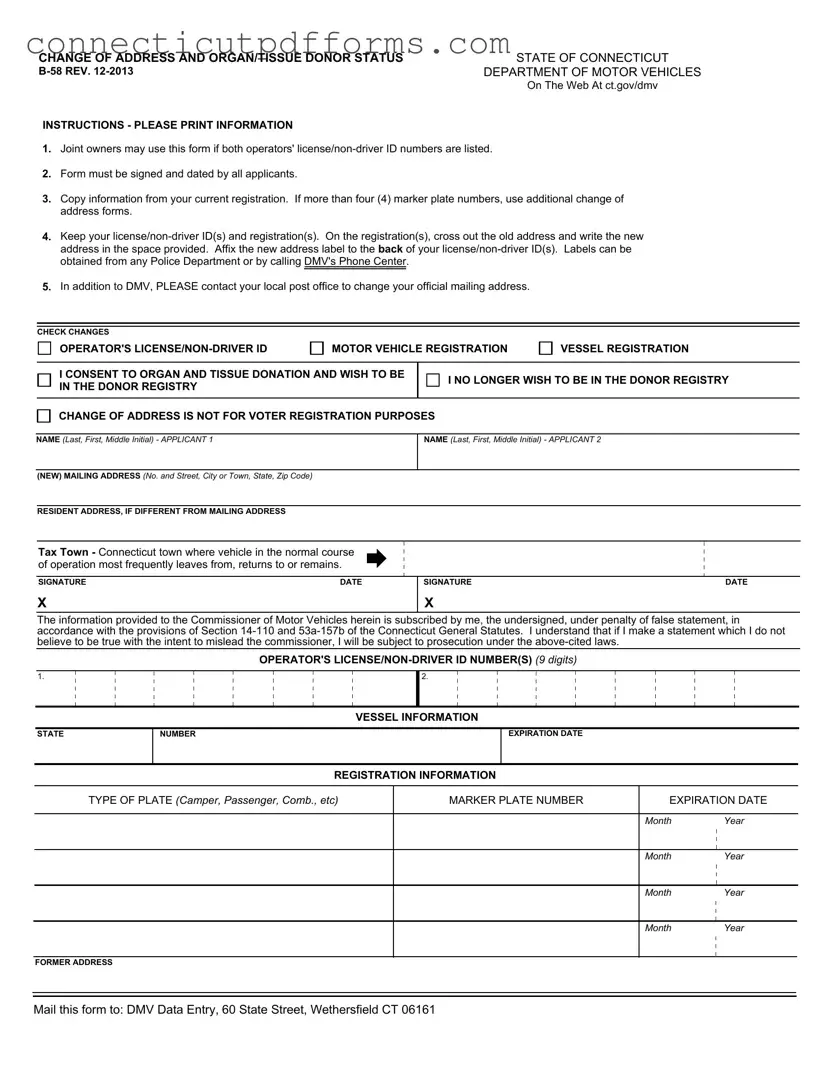

The Connecticut B 58 form is similar to the Change of Address form used by the United States Postal Service (USPS). Both documents allow individuals to officially update their address information. The USPS form is essential for ensuring that mail is forwarded to the new address, while the B 58 form updates the state’s records related to driver’s licenses and vehicle registrations. Both forms require personal information, including names and old addresses, to facilitate the transition to the new address. Additionally, both forms can be submitted online or by mail, making the process convenient for users.

Another similar document is the DMV Change of Address form used in other states. Like the Connecticut B 58, these forms enable residents to change their address for their driver's license and vehicle registration. Each state has its own version, but the purpose remains the same: to keep state records accurate and up to date. These forms typically require the same basic information, such as the applicant’s name, old address, and new address. They also often require the applicant’s signature to verify the change.

The Voter Registration Change form is another document that shares similarities with the B 58 form. While the B 58 form focuses on updating address information for motor vehicle records, the Voter Registration Change form is specifically for updating a voter’s address in the electoral system. Both forms require personal identification and old and new address details. However, it is crucial to note that the B 58 form explicitly states it is not for voter registration purposes, highlighting the need for separate documentation in that context.

The IRS Form 8822, Change of Address, is also comparable to the B 58 form. This form allows individuals to notify the Internal Revenue Service about a change of address for tax purposes. Similar to the B 58, it requires personal information, including the old and new addresses. Both forms aim to ensure that important documents and communications are sent to the correct location. However, the IRS form specifically pertains to tax matters, while the B 58 focuses on motor vehicle and organ donor records.

Understanding the importance of accurate documentation is crucial across various legal contexts, which is evident in the necessity of forms like the Connecticut B 58 and the Durable Power of Attorney. For those navigating ownership transfers, resources such as Templates and Guide can provide essential assistance in ensuring that all legal documents are properly prepared and filed, ultimately safeguarding the interests of all parties involved.

The Health Insurance Portability and Accountability Act (HIPAA) Privacy Rule also requires healthcare providers to update patient records when there is a change of address. This is similar to the B 58 form in that both processes are about maintaining accurate records. Patients must provide their old and new addresses to ensure that medical correspondence and billing information are sent to the right place. While the context differs, the underlying goal of keeping records current is the same.

Lastly, the Social Security Administration (SSA) Change of Address form shares similarities with the B 58 form. Individuals must notify the SSA when they change their address to ensure they receive their benefits without interruption. Like the B 58 form, the SSA form requires personal information and addresses. Both forms help government agencies maintain accurate records, which is essential for providing services to citizens.