The Connecticut Probate form shares similarities with the Last Will and Testament document. Both are essential in the estate planning process, as they outline how a person's assets should be distributed after their death. A Last Will and Testament allows individuals to express their wishes regarding their property and guardianship of minor children. When a will is executed, it must be filed with the probate court to ensure its validity, much like the requirements outlined in the Connecticut Probate form. Both documents require careful attention to detail to ensure that the decedent's intentions are honored and legally recognized.

Another document akin to the Connecticut Probate form is the Codicil. A Codicil serves as an amendment or addition to an existing will, allowing the testator to modify their wishes without rewriting the entire document. Just as the Connecticut Probate form requires timely submission to the probate court, a Codicil must also be filed within the same timeframe to ensure that the changes are legally recognized. This document ensures that updates to a will can be made easily, reflecting any changes in circumstances or intentions.

The Affidavit of Heirship is another document related to the Connecticut Probate form. This affidavit is used when a decedent dies intestate, meaning without a will. It helps establish the rightful heirs of the deceased’s estate. Similar to the Connecticut Probate form, this affidavit must be filed with the probate court to facilitate the distribution of assets according to state laws. Both documents aim to clarify the distribution process, ensuring that the decedent's estate is settled fairly and legally.

A Power of Attorney (POA) is also comparable to the Connecticut Probate form, particularly in terms of authority and responsibility. While a POA grants someone the authority to make decisions on behalf of another person while they are alive, the Connecticut Probate form comes into play after a person's death. Both documents require a trusted individual to act in the best interests of the principal or decedent, ensuring that their wishes are respected. Although their timing differs, both emphasize the importance of having a responsible party manage affairs.

The intricate processes surrounding estate planning in Ohio often lead individuals to consider vital legal documents, including the Last Will and Testament form. This essential document not only specifies how a person's assets should be distributed upon their death but also provides peace of mind, ensuring that their final wishes are honored. Just as various forms of legal documentation assist in managing estate affairs, the Last Will serves as a cornerstone for individuals to express their intentions clearly and avoid potential disputes among heirs.

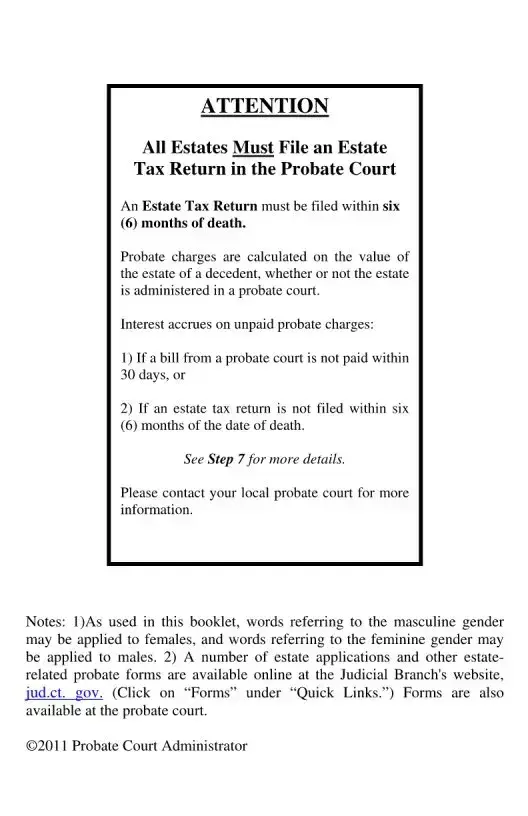

The Estate Tax Return is another document that parallels the Connecticut Probate form. When a decedent passes away, an Estate Tax Return must be filed to report the value of the estate and calculate any taxes owed. This process is crucial for settling the estate, just as the Connecticut Probate form outlines the steps necessary for administering the estate. Both documents serve to ensure that all financial obligations are met before assets are distributed to beneficiaries.

Lastly, the Small Estate Affidavit is similar to the Connecticut Probate form in that it provides a simplified process for settling estates of limited value. If the total value of a decedent's assets is below a certain threshold, this affidavit can be used to bypass the lengthy probate process. Like the Connecticut Probate form, it allows for a more streamlined approach to estate administration, ensuring that heirs can access their inheritance without unnecessary delays, provided all legal requirements are met.