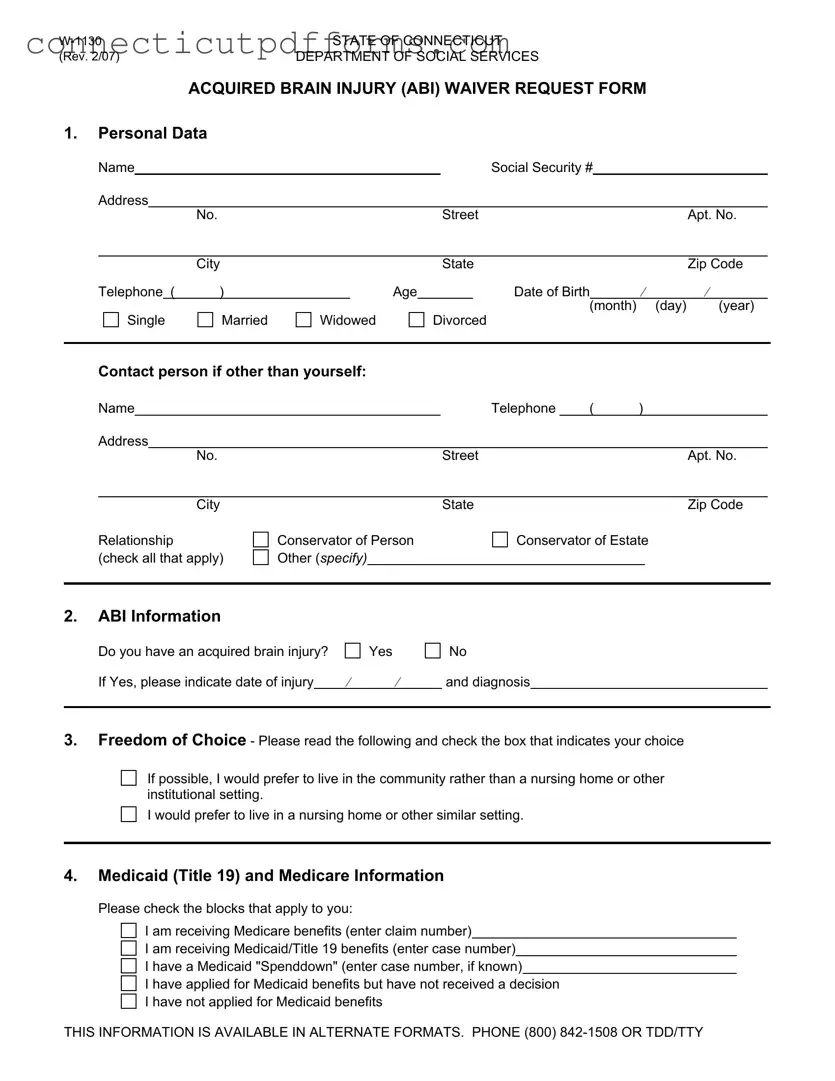

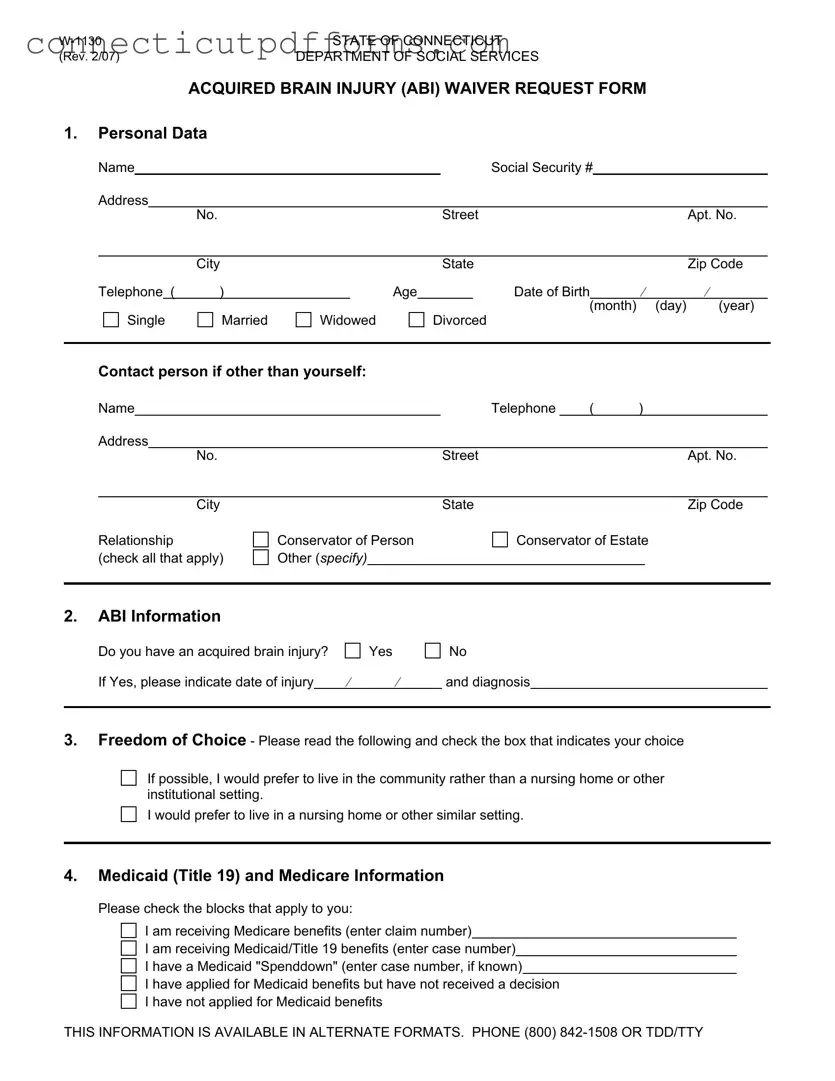

The Connecticut W-1130 form is primarily used to request services under the Acquired Brain Injury (ABI) Waiver. One document that shares similarities is the Medicaid Application Form. Both forms collect personal information and financial data to determine eligibility for services. Just like the W-1130, the Medicaid Application requires details about income and assets, ensuring that applicants meet the financial criteria necessary for assistance. Both forms also emphasize the importance of accurate information, as discrepancies can lead to delays or denials in service provision.

Another document akin to the W-1130 is the Social Security Disability Insurance (SSDI) Application. This application is designed for individuals seeking financial assistance due to disabilities, including brain injuries. Similar to the W-1130, the SSDI application requires personal details, medical history, and information about the applicant's work history. Both documents aim to assess the individual's eligibility for support, making them crucial for those navigating the complexities of disability benefits.

The Supplemental Security Income (SSI) Application also parallels the W-1130 form. Like the W-1130, the SSI application focuses on providing financial aid to individuals with limited income and resources. It requires detailed financial disclosures and personal data, just as the W-1130 does. Both forms serve to evaluate the applicant's situation comprehensively, ensuring that those in need receive the appropriate assistance.

The Long-Term Care Application shares similarities with the W-1130 form as well. This document is utilized by individuals seeking long-term care services, whether in a facility or at home. Both forms gather information about the applicant's health condition, living preferences, and financial status. The Long-Term Care Application, like the W-1130, helps determine the level of care and support an individual qualifies for, making it an essential tool in the process of securing necessary services.

The Home and Community-Based Services (HCBS) Waiver Application is another document that resembles the W-1130. The HCBS application is designed for individuals seeking community-based support rather than institutional care. Both forms require personal and financial information to evaluate eligibility for services. They aim to empower individuals to live independently while ensuring that appropriate resources are allocated based on their specific needs.

The Individualized Service Plan (ISP) is also comparable to the W-1130 form. While the ISP is typically created after eligibility is established, it shares the focus on understanding the individual's needs and preferences. The W-1130 collects initial data that can inform the development of an ISP, ensuring that the services provided align with the individual's goals and circumstances. Both documents emphasize a person-centered approach to care and support.

The Client Assessment Form is another document similar to the W-1130. This form is often used to evaluate an individual's needs for various support services. Like the W-1130, it gathers essential personal and health information to create a comprehensive picture of the client's situation. Both forms aim to facilitate access to necessary resources and services, ensuring that individuals receive the care they require.

For those navigating rental agreements in New York, understanding the intricacies of various forms is essential. One valuable resource to aid in this process is the Templates and Guide, which provides comprehensive insights and templates that streamline the leasing process. These tools not only clarify the terms and obligations laid out in significant agreements but also empower both landlords and tenants to engage confidently in their transactions.

Finally, the Family Caregiver Support Program Application shares characteristics with the W-1130 form. This application is intended for caregivers seeking assistance and resources to support their loved ones. Both forms gather information about the individual needing care, as well as the caregiver's situation. By collecting relevant data, both documents help connect individuals and families with the support they need to navigate the challenges associated with caregiving and disabilities.