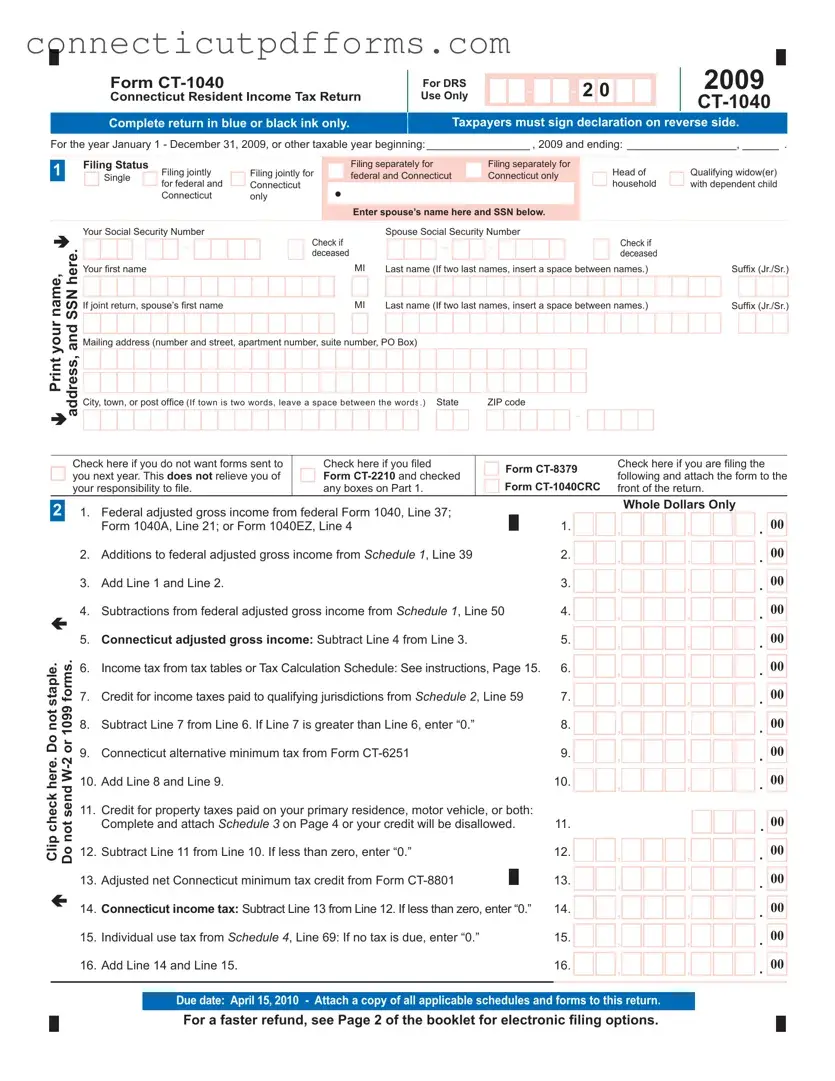

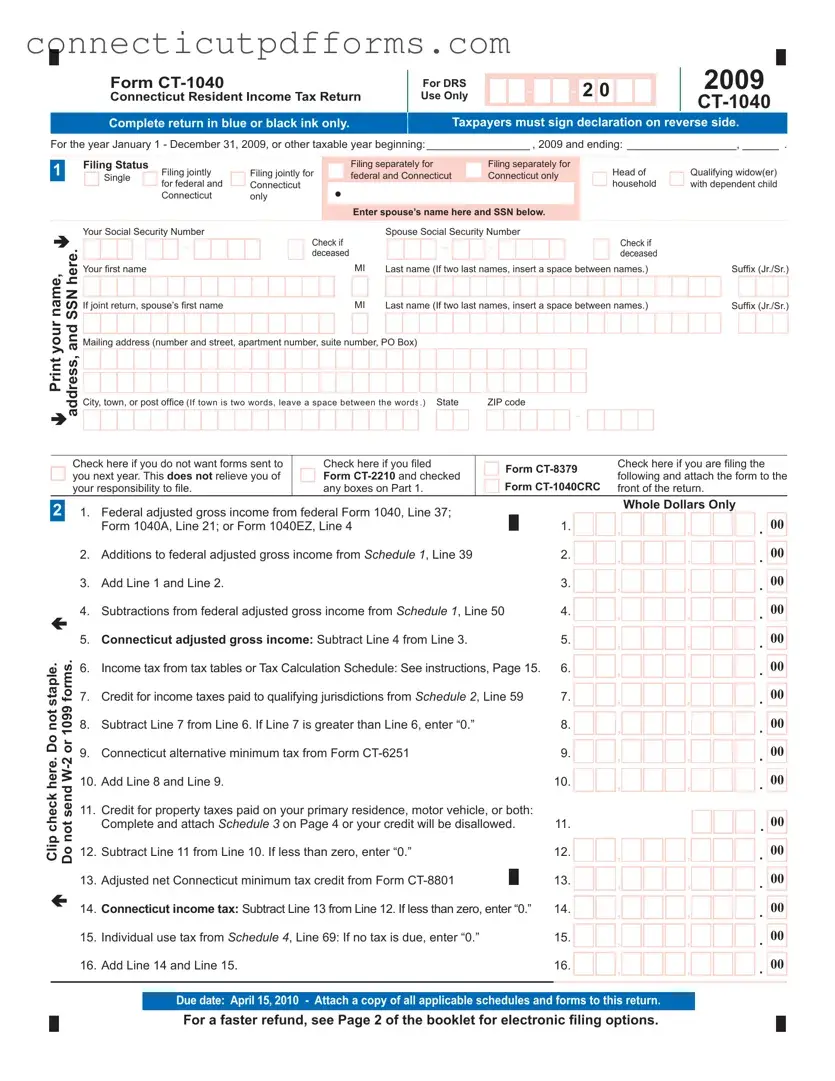

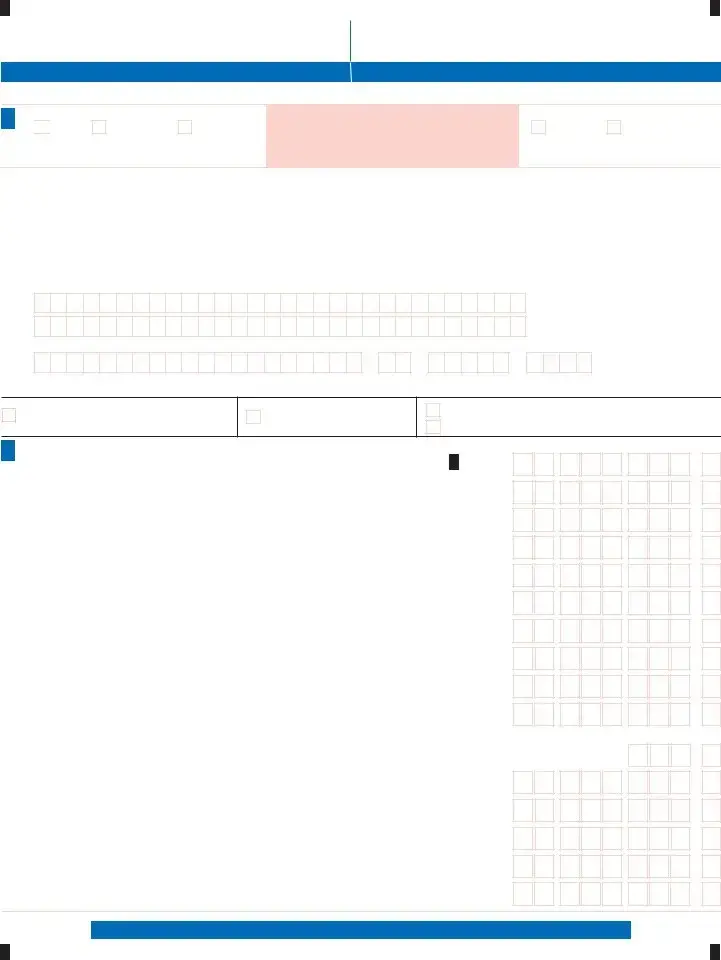

The IRS Form 1040 serves as a foundational document for individual income tax returns across the United States. Like the CT-1040, it requires taxpayers to report their income, deductions, and credits to determine their tax liability. Both forms necessitate similar personal information, including filing status, Social Security numbers, and income details. However, while the IRS Form 1040 is a federal document, the CT-1040 specifically addresses state income tax obligations for Connecticut residents, reflecting the unique tax laws and regulations of the state.

The IRS Form 1040A simplifies the tax filing process for individuals with straightforward tax situations, much like the CT-1040. Taxpayers using Form 1040A can report income, claim certain deductions, and receive credits, but they must meet specific criteria, such as having a taxable income below a certain threshold. Both forms allow for joint filing and share similar structures, but the CT-1040 incorporates state-specific elements that cater to Connecticut's tax laws, making it essential for residents.

The IRS Form 1040EZ was designed for simple tax situations, making it comparable to the CT-1040 in its straightforward approach. Taxpayers who qualify can use this form to report their income and claim a standard deduction without itemizing. While both forms are user-friendly, the CT-1040 includes additional sections pertinent to Connecticut tax credits and deductions, which are not present in the federal 1040EZ.

Form CT-2210 is relevant for Connecticut taxpayers who may owe a penalty for underpayment of estimated tax. This form is similar to the CT-1040 in that it requires detailed income information and calculations to determine any penalties owed. Both forms necessitate accurate reporting of income, and the CT-2210 is often filed alongside the CT-1040 to address any additional tax liabilities that may arise from insufficient estimated payments.

For those looking to formalize their rental agreements, understanding the importance of documentation is crucial; much like the Residential Rental Contract ensures clear expectations between landlords and tenants, detailed tax forms likewise serve to safeguard individuals' financial obligations and rights with precision.

The IRS Form 1099 series, particularly the 1099-MISC, is similar to the CT-1040 in that it reports various types of income received outside of traditional wages. Just as the CT-1040 requires taxpayers to include all sources of income, including those reported on 1099 forms, the IRS 1099 serves as a crucial document that ensures all income is accounted for when filing taxes. Both forms emphasize the importance of accurate income reporting to determine tax obligations.

Form CT-6251 is Connecticut's alternative minimum tax form, which parallels the federal IRS Form 6251. Both forms are designed to calculate whether taxpayers owe alternative minimum tax based on specific income and deduction scenarios. The CT-6251 is used in conjunction with the CT-1040, ensuring that taxpayers comply with both state and federal tax laws regarding minimum tax requirements.

Schedule C, used for reporting income or loss from a business, shares similarities with the CT-1040 in that both require detailed income reporting. For self-employed individuals, the income reported on Schedule C must be included on the CT-1040, reflecting the comprehensive nature of income reporting in both documents. Each form emphasizes the importance of accurate income tracking to ensure proper tax calculations.

Form CT-8379 allows for the allocation of a tax refund to a spouse in cases of joint filing. This form is similar to the CT-1040 in that it requires the same personal and financial information to determine eligibility for the refund. Both forms work together to ensure that taxpayers can appropriately manage their joint tax situations, particularly in cases of divorce or separation.

The IRS Form 8888 is used to allocate refunds to multiple accounts, which is a concept echoed in the CT-1040’s section on refund distribution. Both forms allow taxpayers to specify how they wish to receive their refunds, either through direct deposit or check. This feature enhances taxpayer convenience and ensures that individuals can manage their finances effectively after filing their tax returns.

Lastly, the IRS Form 4868 is the application for an automatic extension of time to file a federal tax return, similar to the CT-1040 EXT for Connecticut. Both forms allow taxpayers to extend their filing deadlines, though they must still pay any taxes owed by the original due date. This shared purpose emphasizes the importance of timely tax compliance, even when extensions are granted.

Single

Single