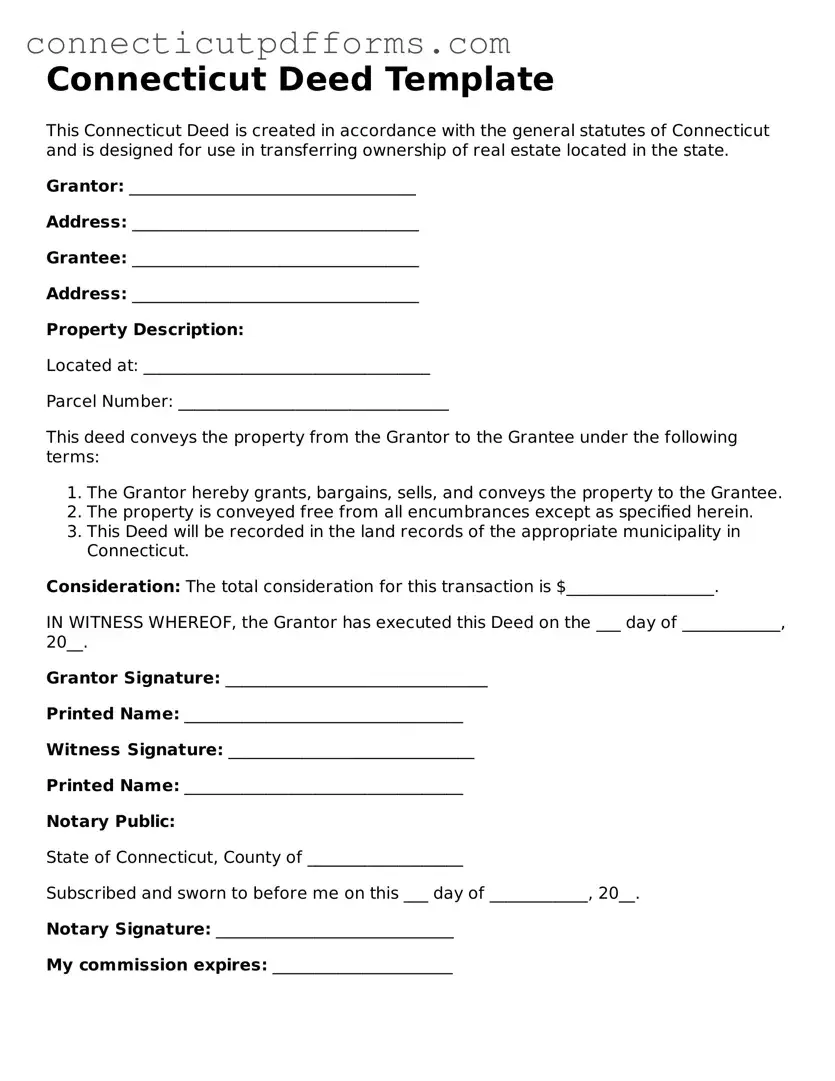

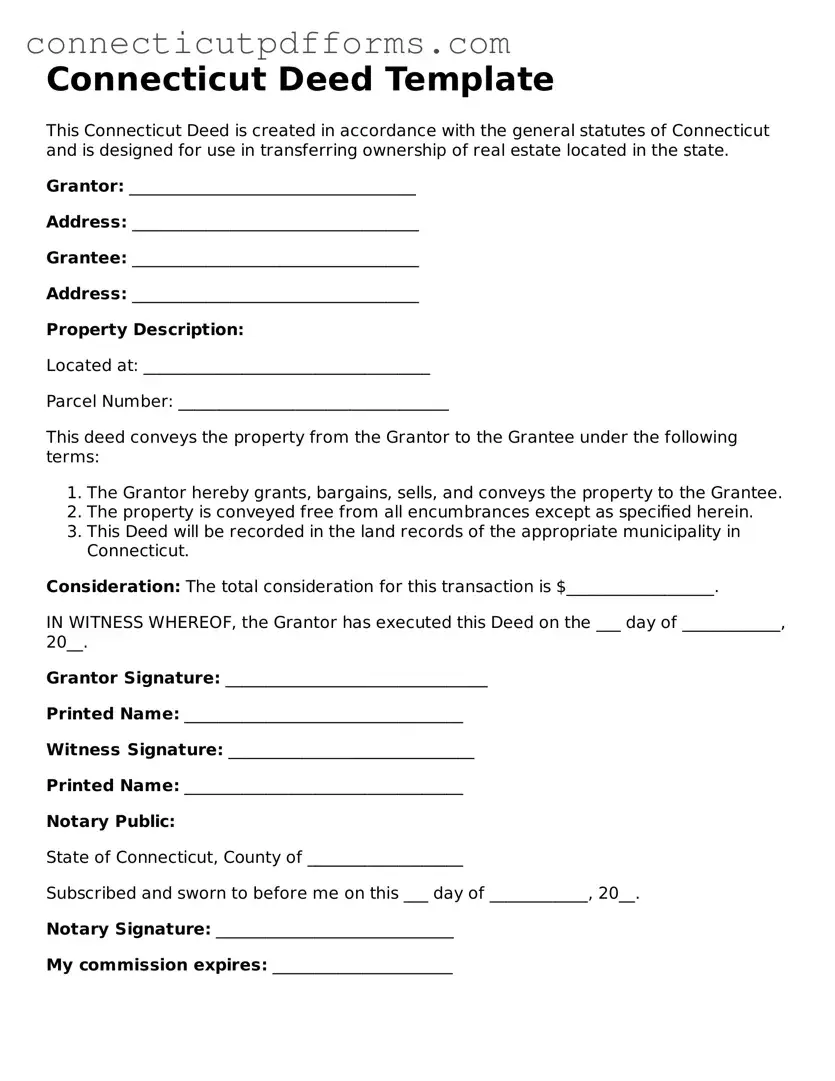

Fillable Deed Form for Connecticut

A Connecticut Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Connecticut. This form serves as an essential tool in real estate transactions, ensuring that the transfer is documented and recognized by the state. For those looking to navigate property transfers, filling out the deed form accurately is crucial; click the button below to get started.

Launch Editor Now

Fillable Deed Form for Connecticut

Launch Editor Now

Finish the form without slowing down

Edit your Deed online and finish with a quick download.

Launch Editor Now

or

▼ Deed PDF Form