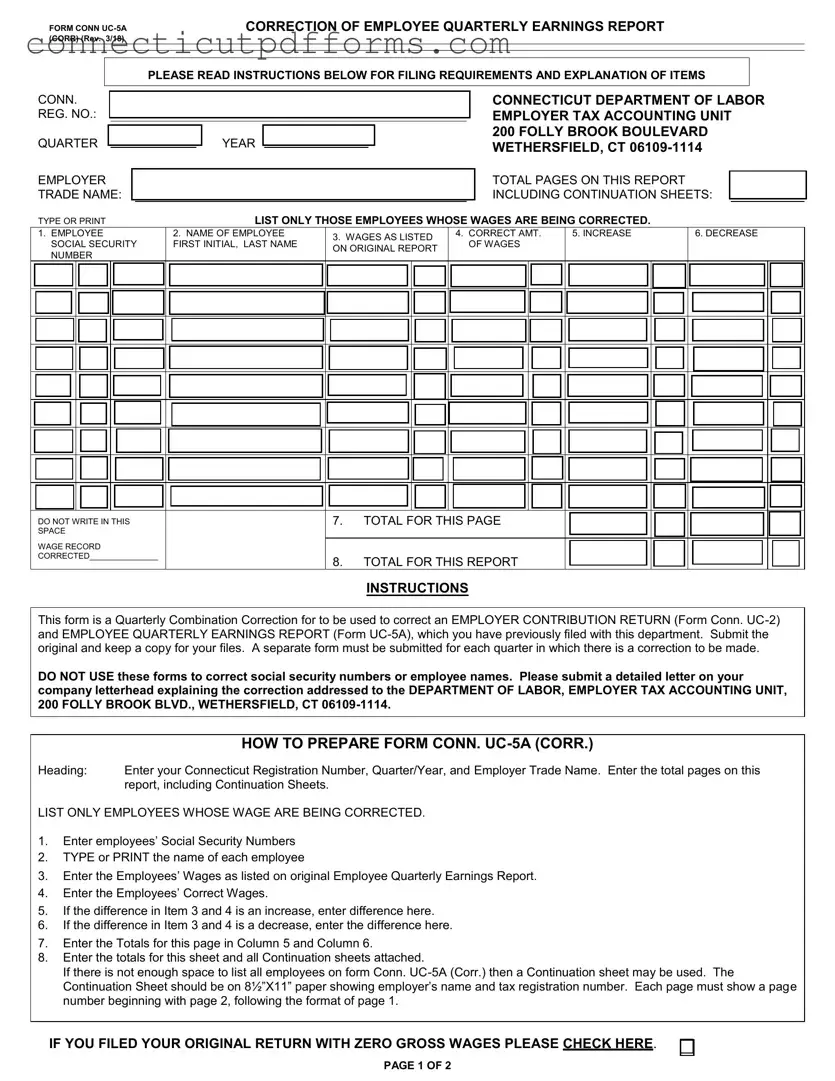

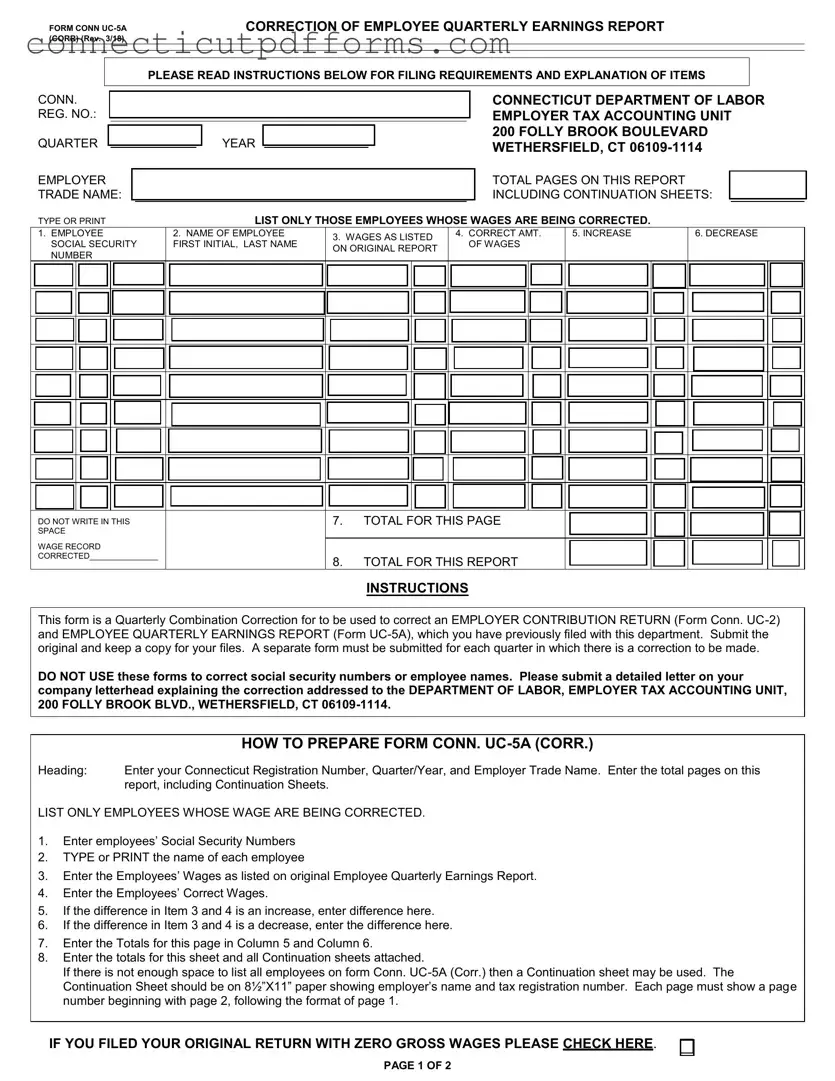

Free Employee Quarterly Earnings Report PDF Template

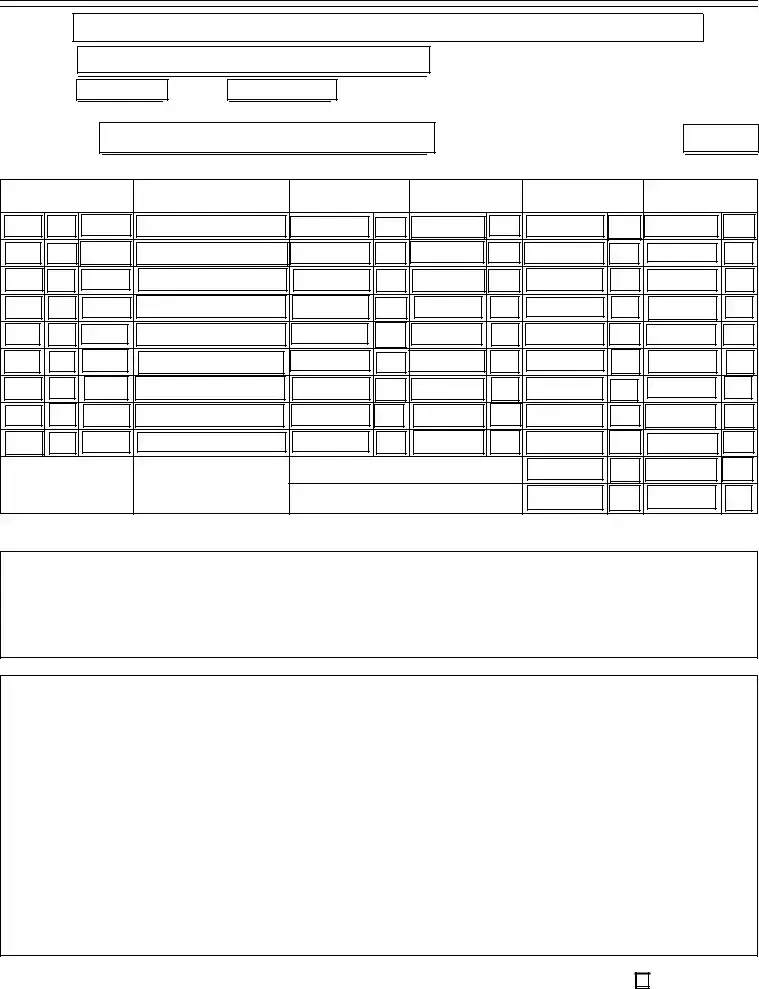

The Employee Quarterly Earnings Report form, known as Form Conn. UC-5A (Corr), is designed to correct previously filed employer contribution returns and employee earnings reports. This essential document ensures that any inaccuracies in employee wages can be rectified, maintaining compliance with state regulations. Each quarter requiring a correction mandates a separate submission, so it’s important to complete this form accurately and promptly.

To ensure your corrections are processed smoothly, please fill out the form by clicking the button below.

Launch Editor Now

Free Employee Quarterly Earnings Report PDF Template

Launch Editor Now

Finish the form without slowing down

Edit your Employee Quarterly Earnings Report online and finish with a quick download.

Launch Editor Now

or

▼ Employee Quarterly Earnings Report PDF Form