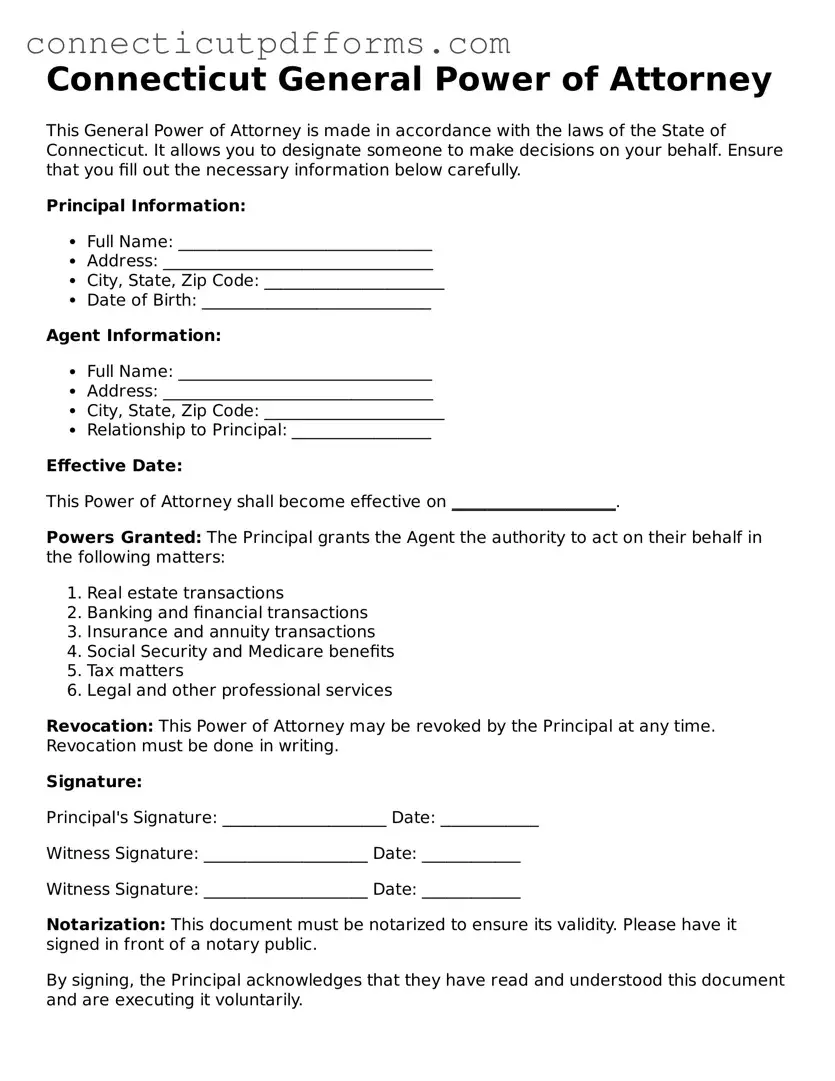

When filling out the Connecticut General Power of Attorney form, many individuals inadvertently make mistakes that can lead to confusion or even invalidate the document. One common error is failing to specify the powers granted to the agent clearly. Without clear instructions, the agent may not understand their authority, which can create complications when they need to act on your behalf.

Another mistake involves not signing the form in the presence of a notary public. In Connecticut, a power of attorney must be notarized to be legally binding. Skipping this step can render the document ineffective, meaning your agent may not be able to perform the necessary actions when required.

Many people also forget to date the document. A missing date can create uncertainty about when the powers take effect. This can lead to disputes or confusion, especially if the form is presented long after it was intended to be used.

In addition, individuals often neglect to provide alternate agents. If the primary agent is unavailable or unwilling to act, having a backup can ensure that your affairs are managed without interruption. Omitting this can leave your interests unprotected during critical times.

Some people make the mistake of not discussing their intentions with the chosen agent before completing the form. It’s essential that the agent understands their responsibilities and is willing to accept them. Otherwise, you might find yourself in a situation where your agent cannot or does not want to fulfill their duties.

Another frequent oversight is not reviewing the form for accuracy. Simple errors, such as misspelled names or incorrect addresses, can lead to complications. It’s important to double-check all information to ensure that it is correct and up to date.

People sometimes fail to consider the scope of the authority granted. A General Power of Attorney can provide broad powers, but if you only want to give specific authority, be sure to outline those clearly. Otherwise, your agent might act outside your intended limits.

Some individuals overlook the importance of keeping the document safe. Once completed, the power of attorney should be stored in a secure location. If it’s lost or misplaced, it can create significant issues when you need it most.

Additionally, failing to inform relevant parties about the existence of the power of attorney can lead to misunderstandings. Banks, healthcare providers, and other institutions should be made aware that your agent has the authority to act on your behalf. Without this knowledge, they may refuse to recognize the agent’s authority.

Finally, many forget to periodically review and update the power of attorney. Life circumstances change, and so do relationships. Regularly revisiting the document ensures that it reflects your current wishes and that your chosen agent is still the right person for the job.