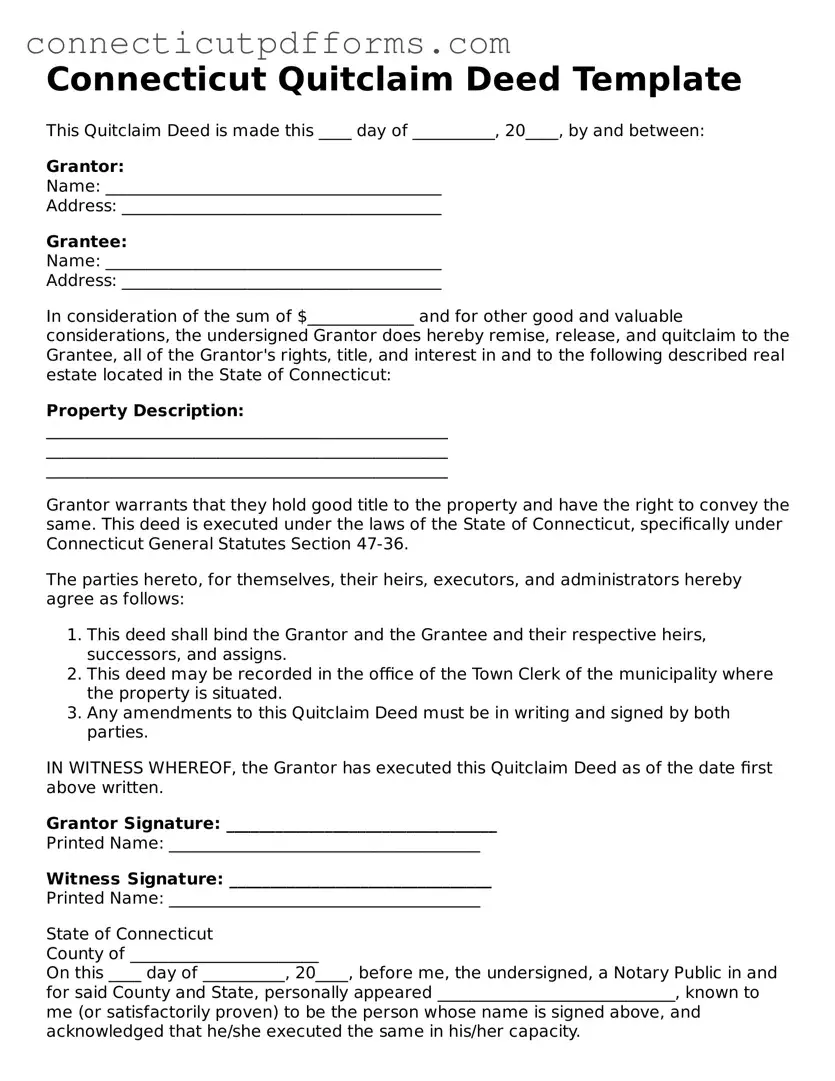

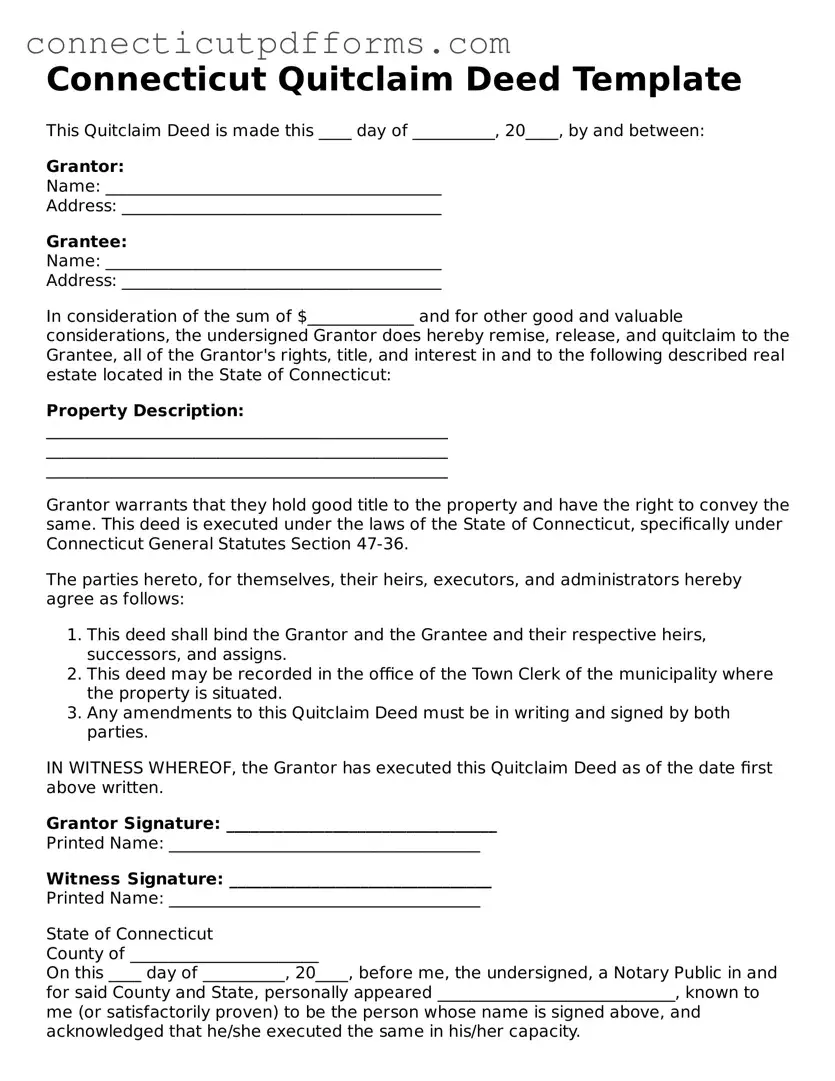

Fillable Quitclaim Deed Form for Connecticut

A Connecticut Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the property’s title. This form is particularly useful for conveying property between family members or in situations where the seller cannot guarantee clear title. To initiate the transfer process, consider filling out the form by clicking the button below.

Launch Editor Now

Fillable Quitclaim Deed Form for Connecticut

Launch Editor Now

Finish the form without slowing down

Edit your Quitclaim Deed online and finish with a quick download.

Launch Editor Now

or

▼ Quitclaim Deed PDF Form