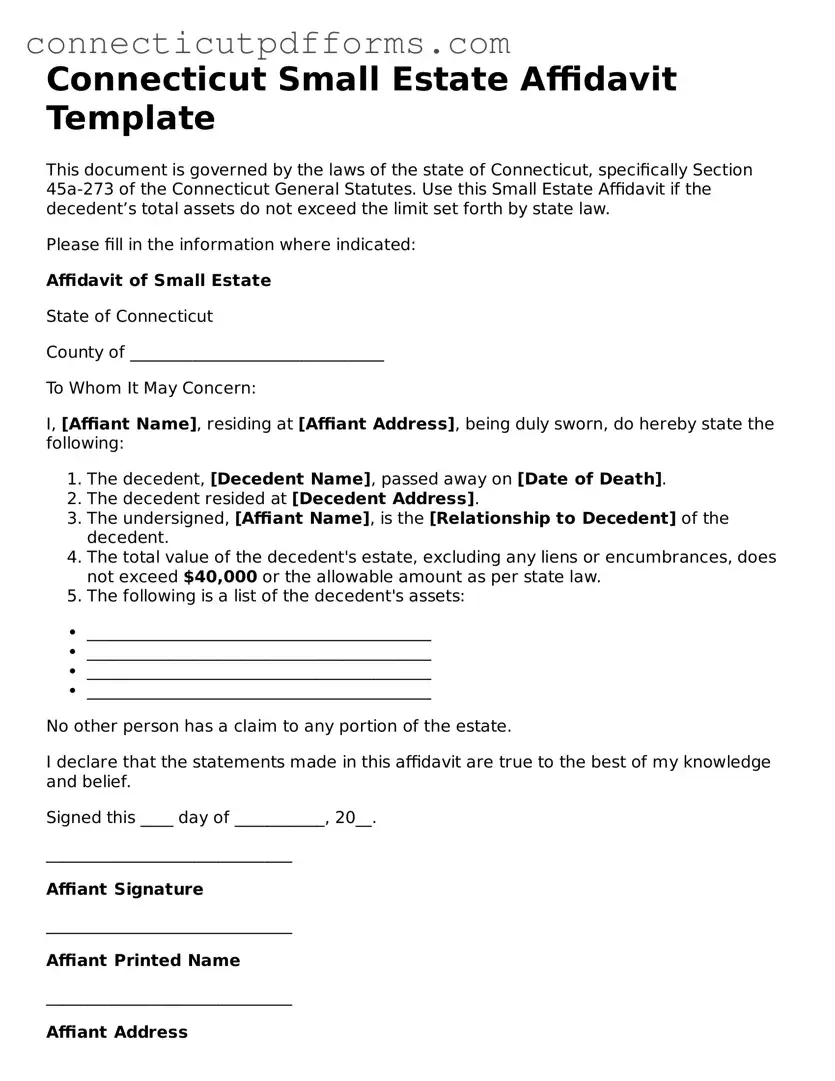

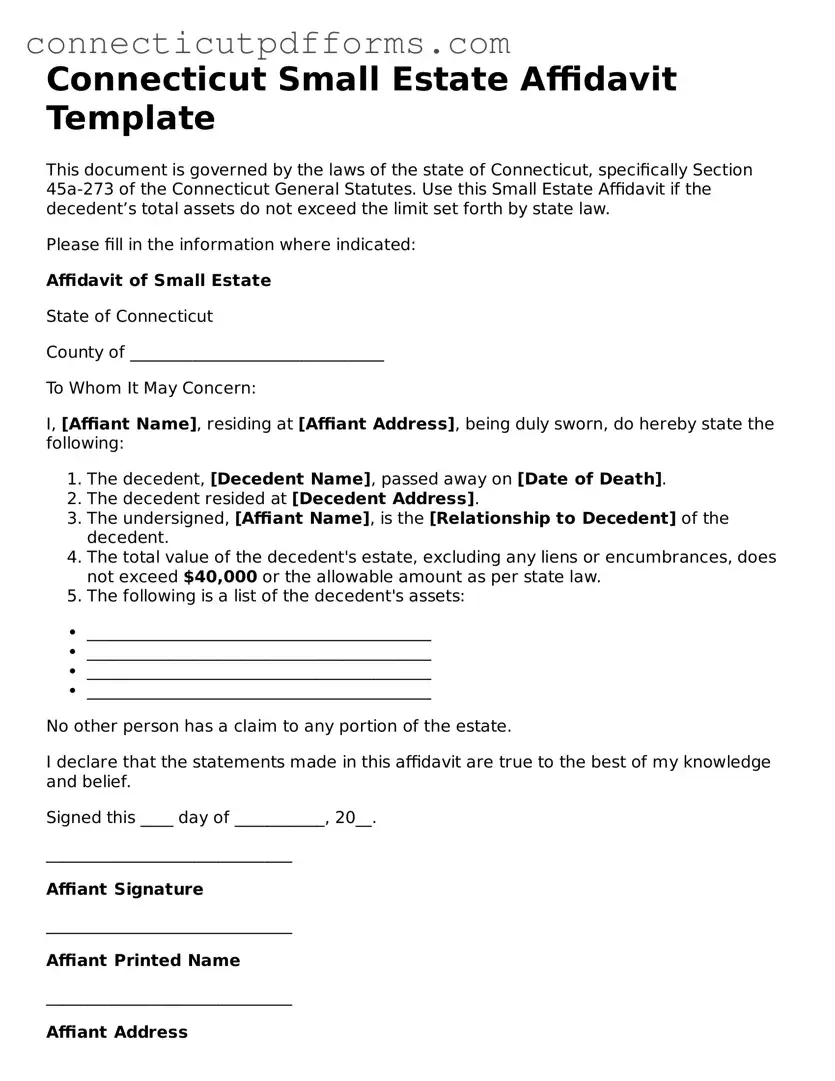

Fillable Small Estate Affidavit Form for Connecticut

The Connecticut Small Estate Affidavit form is a legal document that allows individuals to settle the estate of a deceased person when the total value of the estate is below a specified threshold. This process simplifies the transfer of assets without the need for formal probate proceedings. Understanding how to properly complete this form is essential for those looking to manage small estates efficiently.

To begin the process of filling out the form, click the button below.

Launch Editor Now

Fillable Small Estate Affidavit Form for Connecticut

Launch Editor Now

Finish the form without slowing down

Edit your Small Estate Affidavit online and finish with a quick download.

Launch Editor Now

or

▼ Small Estate Affidavit PDF Form